The Best UK Stock Brokers in 2024

There are hundreds of FCA-regulated UK stock brokers active in the online space that allow you to purchase and sell companies at the click of a button. The process rarely takes more than a few minutes.

In this guide, we explore some of the popular UK stock brokers to trade with in 2023. We cover key factors like fees, dealing charges, tradable shares, customer support and regulation. For more detailed explanation, please scroll down.

UK Stock Brokers at a glance

- There are many different online stock brokers to choose from, so users should carefully review and analyse the suitable broker to support their investments

- The range of stocks, trading fees, platforms, trading tools, research resources, mobile experience and licensing are all important factors to keep in mind.

- Users can also get a glance on reviewing brokerages that allow stock trading as well as CFD trading options.

The Popular UK Stock Brokers in 2023

If you don’t have time to read our guide in full, here’s a list of some of the popular stock brokers in the UK in 2022.

- eToro

- XTB

- Alvexo

- Trade Nation

- Fineco Bank

- Plus500

- Pepperstone

- AvaTrade

- Hargreaves Lansdown

- Trading 212

- Degiro

- Barclays

- Freetrade.io

- IG Index

- AJ Bell

- Interactive Investor

- Halifax Share Dealing

With hundreds of UK stock broker sites now active in the market, knowing which platform to sign up with has never been more challenging. For example, while some UK stock brokers might stand out for offering super-low fees, they might not give you access to international markets.

With this in mind, below you will find our selection for the popular stock brokers of 2022.

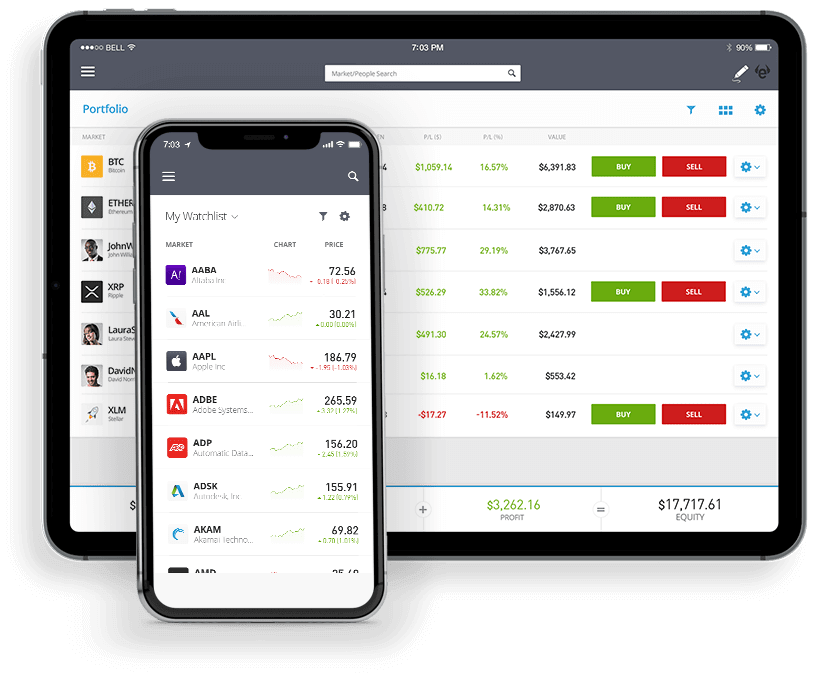

1. eToro

76% of retail investors lose money trading CFDs at this site. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

eToro is a popular UK stock broker, and a FCA-regulated platform in the UK. First and foremost, the stock broker allows you to invest in traditional stocks without paying any commission or share dealing charges. Instead, the only ‘fee’ that you pay is that of the spread. As long as you do not apply leverage or short-sell your chosen company, you will be entitled to company dividends as and when they are paid.

In terms of markets, eToro lists more than 800 equities. This includes major companies listed on the London Stock Exchange, as well as US firms. As such, you’ll get to purchase shares in companies like Apple, Facebook, and Microsoft without the need to pay any fees. Heaps of other stock markets (17 in total) are covered at eToro – including but not limited to Australia, Canada, Sweden, and Germany. If you’re looking to dabble in other areas of the investment space, eToro also gives you access to funds and ETFs.

eToro also offers a copy trading feature. For those unaware, this allows you to copy the trades of seasoned investors. In terms of getting started, it takes just minutes to open an account at eToro, and you may deposit funds on a basis via a debit, e-wallet, or UK bank account.

The minimum deposit stands at $50. As all eToro balances are displayed in US dollars, your deposit will come with a small 0.5% conversion fee. This does, however, allow you to access both UK and international stocks with ease. You may deposit up to €2,000 (about £1,800) without needing to upload ID straight away, so users can purchase your chosen shares instantly.

Finally, eToro is a execution only broker, regulated by the FCA, meaning that your funds are safe at all times.

| Commission | 0% on real stocks |

| Withdrawal fee | $5 |

| Inactivity fee | $10 per month after 12 months of no login activity |

| Account fee | None |

| Minimum deposit | $50 |

| Stocks markets | Access to 17 stock markets |

| Tradable assets | CFDs, Forex, Commodities, Cryptocurrencies, real Stocks and ETFs, indices |

| Available Trading Platforms | Web-based trading platform, mobile trading app |

2. XTB

77% of retail CFD accounts lose money.

XTB is a popular UK stock broker that offers trading on more than 2,100 shares and ETFs – all 100% commission-free. Furthermore, spreads at this broker start at just 0.015% for US-listed stocks, making it one of the cheapest options available for UK traders. XTB doesn’t require a minimum deposit to get started and the broker doesn’t charge deposit or withdrawal fees.

XTB’s custom-built stock trading platform – xStation 5, is also available for the web and mobile devices and it comes packed with research tools. You’ll find technical charts and dozens of studies to start, plus a market news feed that includes actionable trade ideas with annotated price charts. The platform also has a market sentiment gauge which allows users to easily see what other traders think about where a stock’s price is headed.

XTB’s platform also includes a stock and ETF screener, which can be really useful for traders. With this tool, users can easily scan the market for stocks that are taking off or that seem poised for a fall. Using the screener, it’s possible to create watchlists and narrow down your search to find better trading opportunities.

XTB is regulated by the UK FCA and CySEC and offers negative balance protection for all traders. In addition, the broker offers customer support by phone, email, and live chat, available 24/5.

| Commission | 0% |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | £10 per month after 1 year of no activity |

| Account fee | None |

| Minimum deposit | £10 |

| Stock markets | Over 3000 stock CFDs from 16 global exchanges |

| Tradable assets | Stock CFDs, ETF CFDs, Shares, Forex, Indicies, Commodities |

| Available trading platforms | xStation 5 and xStation mobile |

3. Alvexo

76.22% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Alvexo is a European CFD broker that offers trading on stocks, forex, commodities, and more. The platform offers competitive spreads, your choice of trading platform, and a wealth of various tools to help you time the market.

Alvexo offers hundreds of shares and ETFs, mainly from the NASDAQ and NYSE markets in the US. All share CFD trades are commission-free and spreads are typically around 2-3% per share trade. Users have the chance to get discounted spreads if you have at least €10,000 in your trading account.

With Alvexo, you may choose between trading with the proprietary web trading platform or MetaTrader 4. Alvexo’s Web Trader is quite comprehensive, offering everything you need to analyze price movements and place trades. Alvexo also offers a mobile app for iOS and Android so users can trade on the go.

Alvexo also offers a premium service, called Alvexo Plus. This service provides traders with access to daily trading signals, market news, webinars, and an economic calendar.

Alvexo is regulated by the Financial Services Authority of Seychelles. All users receive 1-on-1 support at least once per month. You need at least €500 to open a new account.

| Commission | 0% |

| Deposit fee | Free |

| Withdrawal fee | None |

| Inactivity fee | €10 per month after 3 months |

| Account fee | None |

| Minimum deposit | €500 |

| Stock Markets | Hundreds of shares from the US and Europe |

| Tradable assets | Stock CFDs, Forex, Indices, Commodities, Cryptocurrencies |

| Available Trading Platforms | Mobile Apps, Web Platform, MetaTrader 4 |

4. Trade Nation

75% of retail investor accounts lose money when trading CFDs with this provider.

Trade Nation is a well-established stock broker known for its reliability and comprehensive range of services. As an FCA regulated broker, traders can trust that their investments are in safe hands. Trade Nation offers a diverse selection of trading options, including stocks, CFDs, spread betting, and forex trading. One of the standout features of Trade Nation is its commitment to providing low-cost fixed spreads, starting from an impressive 0.6 pips for CFDs, ensuring traders can navigate the markets without any surprise fees.

In addition to its impressive range of services, Trade Nation offers compatibility with popular trading platforms, including MetaTrader 4 (MT4) and TN Trader. MetaTrader 4 is renowned for its user-friendly interface and advanced charting capabilities. It is a preferred choice for many traders due to its extensive range of technical indicators, customizable charts, and automated trading options through Expert Advisors (EAs). With Trade Nation’s integration of MT4, traders can access a seamless trading experience with all the familiar features they rely on for their trading decisions.

Trade Nation has developed its proprietary trading platform, TN Trader, catering to traders who prefer a platform tailored to the broker’s offerings and user experience. TN Trader boasts a user-friendly interface and is equipped with a suite of tools, including advanced charting, analysis tools, and real-time market data. It is an excellent option for traders who prefer a platform specifically designed to complement Trade Nation’s services and trading conditions.

Trade Nation also provides regulated signals software that can be used to guide stock trading decisions. As well as this, users can also access a variety of educational resources and analysis tools that can be used to improve trading strategies and make informed stock trading decisions. Users can practice different strategies with the free demo account.

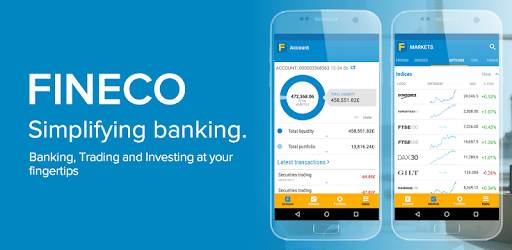

5. Fineco Bank

Your capital is at risk

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license

| Commission | Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. |

| Deposit fee | Free |

| Withdrawal fee | $0 |

| Inactivity fee | None |

| Account fee | None |

| Minimum deposit | £0 |

| Stocks markets | Access to 13 stock markets |

| Tradable assets | CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, |

| Available Trading Platforms | Web-based trading platform, mobile trading app, desktop trading platform |

6. Plus500

Plus500 is another UK CFD broker with a huge selection of stocks. The broker carries over 1,500 shares from around the globe, all of which trade with zero commissions. Users have the option to trade with 5:1 leverage on all shares.

Plus500 provides users with a proprietary software comes loaded with watchlists, a market news feed, and an intuitive charting interface. You may also place advanced order types like stop losses to help control your risk when stock trading.

With Plus500’s alert feature, users can set basic price alerts on the web or on mobile devices, plus create more nuanced alerts that trigger when a stock gains a certain percentage in a day or surpasses a specific trading volume threshold. Investors can even set multiple alerts for the same stock as well.

The only downside to Plus500 is that the trading platform doesn’t have a ton of technical firepower for most advanced stock trading. The software cannot integrate with other tools like TradingView or MetaTrader, so you’re limited to the tools that Plus500 provides. This won’t be an issue for most traders, but it’s something that more experienced investors will want to be aware of.

Plus500 is regulated by the UK FCA. The platform offers 24/7 customer support by phone and email. A new account can be registered with a £100 minimum deposit.

| Commission | 0% |

| Deposit fee | Free |

| Withdrawal fee | $0 |

| Inactivity fee | $10 per month after 3 months of inactivity |

| Account fee | None |

| Minimum deposit | $100 |

| Stock Markets | 1,900 stock CFDs |

| Tradable assets | Users can only trade CFDs with this broker, such as Forex, stock index CFDs, stock CFDs, ETF CFDs, commodities, and crypto CFDs |

| Available Trading Platforms | Mobile App, Web Platform |

7. Pepperstone

Your capital is at risk.

Pepperstone is a popular UK stock brokers for traders who want to use MetaTrader 4 or 5. These popular trading platforms offer unparalleled tools for technical analysis, including the ability to create custom technical studies. You may also backtest trading strategies against historical price data to see how they are likely to perform.

This broker also offers a few extra tools that are built specifically for MetaTrader. For example, there’s a correlation heatmap so investors will be able to see whether the stocks you’re invested in typically move at the same time. There’s also an alarm management tool that lets you create custom alerts based on price changes, trading volume, and more.

Pepperstone carries thousands of share CFDs from the US, UK, Europe, and Australia. The broker’s charges vary based on the market you’re trading - US shares trade commission-free, while UK shares carry a 0.10% commission. So, this broker can be slightly more expensive than some of its peers.

Pepperstone is regulated by the UK FCA and the Australian Securities and Investments Commission (ASIC). The platform doesn’t require a minimum deposit to open an account, which is a major plus if you’re not ready to commit hundreds of pounds to trading just yet.

| Commission | 0% for US shares |

| Deposit fee | Free |

| Withdrawal fee | None |

| Inactivity fee | None |

| Account fee | None |

| Minimum deposit | No minimum deposit |

| Stock Markets | Pepperstone provides access to 250+ stock CFDs |

| Tradable assets | Forex, and other CFD instruments including commodities, stock indices, stock CFDs, and crypto CFDs. |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader. Pepperstone has also partnered with various social trading platforms including Myfxbook, Mirror Trader, MetaTrader Signals, and DupliTrade. |

8. AvaTrade

Your capital is at risk.

AvaTrade is a UK CFD broker that offers 0% commission trading on over 600 global stocks. The platform also carries dozens of exchange-traded funds (ETFs), stock indices, commodities, and forex pairs for trading. Notably, AvaTrade also offers trading on forex options - but it doesn’t offer stock options at this time.

AvaTrade has a few different trading platforms you may use to trade stocks. Like Pepperstone, this broker gives all traders access to MetaTrader 4 and 5.

Alternatively, the AvaTrade web trading platform and AvaTradeGO platform are available on iOS and Android devices as well . You get watchlists, a market news feed, and dozens of technical studies. On mobile devices, users can access full-screen charts and enter orders with just a few taps.

AvaTrade also has its own social trading app for iOS and Android, called AvaSocial. Although this isn’t integrated into AvaTradeGO, it’s simple to switch back and forth between sharing ideas and setting up trades. AvaSocial also enables copy trading, so you have the ability to mimic the portfolios of more experienced stock traders in just a few taps.

AvaTrade is regulated by the UK FCA and Australia’s ASIC. The platform requires a $100 minimum deposit to open an account and you may pay by credit card, debit card, or bank transfer. AvaTrader offers 24/5 customer service.

| Commission | 0% |

| Deposit fee | $100 |

| Withdrawal fee | None |

| Inactivity fee | $50 after 3 months of inactivity and a $100 administration fee after one year. |

| Account fee | None |

| Minimum deposit | No minimum deposit |

| Stock Markets | AvaTrade provides access to 620+ stock CFDs |

| Tradable assets | Forex, CFD trading - index CFDs, stock CFDs, commodity CFDs, Bond CFDs, ETF CFDs. |

| Trading Platforms | WebTrader, MT4 and MT5, AvaOptions, AvaTradeGo, AvaTrade also provides access to social trading via two third-party platforms including DupliTrade and ZuluTrade. |

9. Hargreaves Lansdown

Your capital is at risk.

Hargreaves Lansdown allows you to open a Stocks and Shares ISA (Individual Savings Account) in the UK. The broker also offers Junior ISAs, SIPPs (self-invested personal pensions), and traditional brokerage accounts.

One thing to note about Hargreaves Lansdown is that it’s much more focused on long-term investing than stock trading. The broker’s platform gives you some market analysis tools, including a news feed and individual stock reports. However, you won’t find many technical analysis tools and the charting interface is quite limited in scope.

Hargreaves Lansdown is a popular UK stock broker for investors who want to purchase and sell ETFs as opposed to individual stocks. The broker has a selection of over 3,000 funds to choose from, which no other British stockbroker on our list can match. You get access to a fund finder and other ETF picks from Hargreaves Lansdown’s analysts to help you navigate this huge selection.

This brokerage charges a 0.45% annual fee based on the value of stocks and ETFs you hold inside your ISA. In addition, the brokerage charges a share dealing fee that starts at £11.95 per trade. If you place 20 or more trades per month, the share dealing fee drops to £5.95 per trade.

Hargreaves Lansdown is a publicly-traded company in the FTSE 100 and is regulated by the UK FCA. A new ISA account can be opened with a £100 deposit or by setting up recurring contributions of £25 per month.

| Commission | The fees for stock trading are volume-tiered. The more you trade in the previous month the less commission you pay. 0-9 trades = £11.95 per trade, while 20+ trades made in the previous month incurs a lower commission per trade of £5.95 |

| Deposit fee | $0 |

| Withdrawal fee | None |

| Inactivity fee | None |

| Account fee | None |

| Minimum deposit | $0 |

| Stock Markets | Hargreaves Lansdown provides access to 21 stock markets and 2,500 ETFs. |

| Tradable assets | Stocks, ETFs, Funds, Bonds |

| Trading Platforms | Hargreaves Lansdown native web and mobile trading platforms, as well as IG’s trading platform for CFD and spread betting accounts. |

10. Trading 212

Your capital is at risk.

Trading 212 is a popular UK stock brokers for long-term investors. What makes this platform unique is it’s automated investing feature. You may set up a portfolio with however many stocks you want. Each month - or on whatever schedule you want - Trading 212 will transfer funds from your bank account and reinvest them in the stocks in your portfolio.

Trading 212 also allows you to have different portfolios for different goals. So, users may have a conservative portfolio for retirement investing and a more aggressive portfolio for generating income. You get to decide how much money goes into each portfolio every month.

Users may purchase and sell stocks on Trading 212 with no commissions. The platform also doesn’t charge an account fee, so it’s essentially free to use. The only catch is that there’s a 0.7% deposit fee if you deposit more than £2,000 at once using a credit card or debit card.

Trading 212 also has a CFD trading platform, which similarly offers commission-free stock and ETF trading. You may trade with leverage up to 5:1 and all accounts come with negative balance protection so you may never lose more than you’ve deposited into your account.

Trading 212 is regulated by the UK FCA. All accounts are insured for up to £85,000 under the Financial Services Compensation Scheme.

| Commission | Commission-free stocks and ETFs |

| Deposit fee | $0 |

| Withdrawal fee | None |

| Inactivity fees | None |

| Account fee | None |

| Minimum deposit | $1 for CFD accounts and $10 for Invest or ISA accounts |

| Stock Markets | Trading 212 provides access to 7 stock markets and 200 ETFs. |

| Tradable assets | CFDs, forex, real Stocks and ETFs, |

| Trading Platforms | AutoInvest, Trading 212 proprietary web trading platform, mobile trading app |

11. Degiro

Investing involves risk of loss.

If you're looking to diversify your portfolio by investing in companies from several countries, it might be worth exploring the merits of Degiro. This trading platform offers thousands of equities from heaps of stock exchanges.

Along with major markets like the UK, US, and Japan - you'll also have access to less liquid exchanges. You will be purchasing the stocks in the traditional sense, meaning that you will be entitled to dividends if and when they are paid.

Degiro is also well-known for offering a super-low fee structure on its stocks. This works out at just £1.75 +0.014% when buying UK shares - at a maximum of £5 per trade. If its US stocks you're after, this works out at just €0.50 + $0.004 per share.

The platform allows you to purchase and sell a selection of 200 ETFs for free, although bear in mind that there are conditions that apply to these. After that, the standard ETF works out at €2 + 0.03% per trade.

It takes 24-48 hours to get your Degiro account set up in the vast majority of cases. This broker is licensed by AFM in the Netherlands.

| Commission | The trading fee is typically calculated as a flat fee and a percentage of the traded volume. US and Canadian markets are charged based on the total shares traded. For example, trading stocks listed on the LSE incur a commission of £1.75 & 0.014% |

| Deposit fee | $0 |

| Withdrawal fee | None |

| Inactivity fee | None |

| Account fee | None |

| Minimum deposit | None |

| Stock Markets | DEGIRO provides access to 30 stock markets and 5,000+ ETFs. |

| Tradable assets | Stocks, ETFs, mutual funds, bonds, options, futures, cryptocurrencies |

| Trading Platforms | Web trading platform, mobile trading app |

12. Barclays

Investing involves risk of loss.

Barclays is one of the biggest investment firms in the UK, and now individual investors can access many of the same tools and investment opportunities as the bank's pro traders. At Barclays, you have two ways to invest. You may invest in ready-made portfolios designed by experts, or users may go their own way and choose their own stock and fund investments.

Barclays offers 5 ready-made portfolios that range from "Defensive" to "Adventurous." Once you invest using these portfolios, Barclays takes care of keeping your portfolio balanced and on track over time. Fees are based on the amount you have invested, but you may expect a ready-made portfolio to cost around £7.75 per month in fees.

If you want to invest on your own, users can also use Barclay's Smart Investor platform. This allows you to open an investment account, ISA, or SIPP with no minimum deposit. You'll pay a commission of £3 for ETF trades or £6 for stock trades, plus an account fee of 0.1-0.2% per month (£4 minimum). Barclays offers funds and shares from the US, UK, and Europe.

Barclays is regulated by the UK's Financial Conduct Authority. If you have questions about what type of account is right for you, you may get in touch by phone or live chat.

| Commission | £3 for ETF trades or £6 for stock trades |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | None |

| Account fee | 01-0.2% per month (£4 minimum) |

| Minimum deposit | None |

| Stock Markets | US, UK, and European markets |

| Tradable assets | Stocks, ETFs, mutual funds, investment trusts |

| Trading Platforms | Web trading platform, mobile trading app |

13. Freetrade.io

Commission-free stocks are available through Freetrade, a UK fintech startup. Trading stocks and ETFs are free with Freetrade. Opening an account is seamless, fully digital, and very fast. It is a well-designed and easy-to-use mobile trading platform. Investing in this fund is a good choice for beginning investors. Stocks and ETFs are the only assets you can trade at Freetrade. Charting tools are only included in the research options. Debit cards may only be used for deposits, and credit or debit cards cannot be used for withdrawals.

Freetrade only offers stocks and ETFs in its product portfolio. Aside from mutual funds, bonds, and options, no other asset classes are available.

Comparatively, this broker's selection falls behind its competitors. There are more stock markets to trade on with Trading 212 and eToro.

You can only trade on Freetrade's mobile platform, no desktop platform, and only Freetrade Plus subscribers can use the web platform in beta.

| Commission | 0.45% fee for converting your funds to USD |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $0 |

| Account fee | $0 |

| Minimum deposit | $0 |

| Stocks markets | UK Stocks, US Stocks, European Stocks |

| Tradable assets | Stock, ETF |

| Available Trading Platforms | Web trading platform, mobile trading app |

15. IG Index

IG Index is a forex, stock and CFD broker. IG offers a user-friendly and well-designed web trading platform. The website contains several useful educational tools. Multiple options are available for funding and withdrawing money. However, IG's trading fees for stock CFDs are high. Because IG offers only CFDs and options trading in most countries, its product portfolio is limited. Customer support could be improved in terms of quality. In addition to their complexity, spread bets and CFDs come with a high risk of losing money rapidly. In this provider's spread bets and CFDs, 75% of retail investor accounts lose money.

Most clients can only trade CFDs, forex, and options at IG. CFDs are available in literally thousands of markets. There are also some countries where residents can trade real stocks, including the UK. There is, however, no access to other popular assets such as mutual funds and bonds.

IG specializes in CFDs and forex trading. Clients from the United States can only trade forex.

Stocks can also be traded if you live in one of the countries that provide this service, such as the UK.

IG has an extremely wide selection of products, whether you are interested in trading currency pairs, stocks, indices, ETFs, or commodities.

| Commission | Variable on asset |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $12/£12/€14 per month after 2 years of inactivity |

| Account fee | $0 |

| Minimum deposit | $0 |

| Stocks markets | US Stock, UK Stock, German Stock |

| Tradable assets | ETF, Forex, Options, CFD, Stocks in some countries, Robo-advisory in UK, IPOs |

| Available Trading Platforms | Web trading platform, mobile trading app |

16. AJ Bell

Formerly known as Sippdeal and AJ Bell Youinvest, AJ Bell is an investment platform offering stocks, shares Isas, and deals accounts.

Founded in 2000, it is also one of the first companies in the UK to offer an online self-invested personal pension (Sipp). Bell also launched Dodl in 2022, a reduced-cost investment app with a limited range of investments (0.15% p.a.).

At AJ Bell, you can buy over 3,700 funds, shares, and investment trusts from 24 markets.

The Financial Services Compensation Scheme (FSCS) protects AJ Bell against financial loss.

Investment platforms registered with the Financial Conduct Authority should ring-fence your money so you can get it back if a company goes out of business without waiting with other creditors.

| Commission | £1.50 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $0 |

| Account fee | 0.25% |

| Minimum deposit | £500 Minimum Investment |

| Stocks markets | UK Stocks |

| Tradable assets | Stocks |

| Available Trading Platforms | Web trading platform, mobile trading app |

17. Interactive Investor

Interactive Investor, also known as ii.co.uk, is one of the UK's most popular execution-only investment services. Share trading fees are charged by Interactive Investor. The Investor Plan offers one free trade per month, while the Super Investor Plan offers two free trades per month. Additionally, foreign exchange fees can be reduced by holding nine foreign currencies.

With over 40,000 investments, including shares, funds, investment trusts, and exchange-traded funds (ETFs), investors have various options. In contrast, fractional shares, cryptocurrencies, and foreign exchange are not available for trading.

On uninvested cash balances in trading accounts, individual savings accounts (ISAs), and Self-Invested Personal Pensions (SIPPs), Interactive Investor pays interest (between 0.5% and 2.0% depending on the type of account and balance).

A social trading forum or community is not available to investors through Interactive Investor.

| Commission | £5.99 |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | None |

| Account fee | £4.99 per month |

| Minimum deposit | None |

| Stocks markets | UK Stocks, US Stocks |

| Tradable assets | Stocks & Shares, ETFs (Share ETFs and Index ETFs), Investment Trusts, Investment Funds, Bonds & Gilts, Venture Capital Trusts (VCTs) |

| Available Trading Platforms | Web trading platform, mobile trading app |

18. Halifax Share Dealing

A UK stockbroker owned by Lloyds Banking Group, part of Halifax (Bank of Scotland). Besides offering low fees, Halifax offers free deposits and withdrawals from your account, and there is an option to open a UK tax-exempt Individual Savings Account (ISA). Investors who are just starting should consider it. Halifax, however, has a limited product selection. No mobile or desktop trading platform is available, and customer support is very poor.

In addition to stocks, ETFs, and funds from multiple international exchanges, Halifax does not offer forex, CFDs, or cryptos.

Through Halifax, you can trade international stocks and ETFs on London, New York, Paris, Frankfurt, Milan, Amsterdam, or Brussels exchanges. Although this is an improvement over some close competitors, it is still a limited selection.

| Commission | 1.25% |

| Deposit fee | None |

| Withdrawal fee | $0 |

| Inactivity fee | None |

| Account fee | £36 per year |

| Minimum deposit | $0 |

| Stocks markets | London, New York, Paris, Frankfurt, Milan, Amsterdam, or Brussels Stock markets |

| Tradable assets | Stock, ETF, Fund, Investment Trusts |

| Available Trading Platforms | Web trading platform |

What is an Online Stock Broker?

If you want to purchase and sell shares, you will need to use an online stock broker. The most reputable UK stock brokers give you the ability to invest in hundreds of UK and international stocks from the comfort of your home.

As and when you find a stock that you like the look of, you simply need to determine how many shares you wish to purchase, and the funds will be taken from your share dealing balance.

Then, you will retain full ownership of the stock until you decide to sell. Most of all, any dividends that your chosen company pays will be added to your brokerage account.

This allows you to re-invest the dividends into other companies, or withdraw the money out to your bank account. Crucially, there is no longer a need to speak with a trading platform over the phone - as everything is facilitated online.

What Features Do Stock Brokers Include?

Understanding the common features that are provided by popular stock brokers is a good way to make an informed decision about which broker to use. Here are a few key features that are offered by most popular stock brokers in the UK.

✔️Security and regulation

In the UK, popular stock brokers are often regulated by the Financial Conduct Authority. This is a regulatory body that aims to protect customers who use financial services. Brokers that are regulated by the Financial Conduct Authority must adhere to regulatory requirements that are put in place to keep users safe.

✔️ Variety of stocks and shares

Diversification is a good way to reduce the risk of investing in stocks and shares. As a result, popular brokers typically offer a variety of assets that enable investors to spread their investments across different markets. For example, some stock brokers may offer traditional stocks and shares as well as CFDs, ETFs, commodities and indices. It is also common to find stock brokers that offer forex and cryptocurrencies. This makes it possible for investors to diversify across different financial markets.

✔️ Trading Platforms and Tools

To effectively trade stocks and manage investments, popular stock brokers provide intuitive and user-friendly trading platforms. These platforms are equipped with powerful tools and features that assist investors in making informed decisions. They offer real-time market data, interactive charts, technical analysis indicators, customizable watchlists, and order execution capabilities. Additionally, some brokers offer advanced trading platforms with features like algorithmic trading, options trading, and access to financial research and insights.

✔️ Mobile trading app

Popular stock brokers often provide mobile apps that can be used by traders to manage their portfolios on the go. These mobile apps offer a streamlined trading experience, allowing investors to monitor their investments, execute trades, access account information, receive real-time market updates, and even set up customizable alerts. With mobile apps, investors can stay informed and take action quickly, regardless of their location.

✔️ Research and Education

Educational resources and research materials can help traders to make more informed trading decisions. As a result, these resources are provided by most popular stock brokers in the UK. Most stock brokers will offer these resources for free, however, some may charge an additional fee to access educational materials.

✔️ Customer Support

As a trader, it is helful to be able to contact customer support services if you run into problems with your trading account. Therefore, popular stock brokers often provide excellent customer support via email, phone or live chat. Some brokers offer a 24/7 support service which means that traders can contact support at any time. Others may offer the service on a 24/5 basis or within market opening hours.

The above features are a few examples of what is offered by some popular brokers in the UK. However, every broker will offer unique features so it is worth researching several options before making any decisions.

Who Is The Largest Broker In The UK?

Hargreaves Lansdown is widely recognized as the largest stock broker in the United Kingdom, offering a range of investment services to individual investors. With a strong reputation and a history dating back to 1981, Hargreaves Lansdown has built a significant presence in the UK financial market. The company provides an extensive platform that allows investors to trade stocks, funds, and other investment products. Its vast customer base, combined with its comprehensive offering, has contributed to its position as a market leader.

Hargreaves Lansdown's prominence can be attributed to its commitment to delivering high-quality services, including user-friendly online platforms, expert research and analysis, and access to a wide range of investment options. Its success as the largest UK stock broker is a testament to its ability to meet the diverse needs of investors and its ongoing dedication to customer satisfaction.

How Do the Popular Online Stock Brokers UK Work?

First and foremost, you will be required to open an account with your chosen broker. This is to ensure that the platform complies with the FCA. This rarely takes more than a few minutes, and simply requires some personal information - such as your full name, home address, date of birth, and contact details.

After that, you will then be instructed to upload a couple of verification documents. This is to ensure that you are who you say you are. Once your account has been verified, users have the option to then deposit some funds. Most of the reputable UK stock brokers allow you to fund your account with a UK debit/credit card or bank account. You will also have the option of depositing funds with an e-wallet like Paypal.

As soon as your UK stock broker account has been funded, users can then proceed to invest. Unless you are using a mutual fund you will need to choose your own companies. Once you know which stocks you want to purchase, you'll need to choose how many shares you want. Notably, you are no longer required to purchase 'whole shares', so you may invest as little as you want as long as this meets the UK stock broker's minimum trade size.

Can I Buy Stocks Without A Broker?

Yes it is possible to buy stocks without a broker in the UK. However, buying stocks with a broker offers several advantages over purchasing them without one. Firstly, brokers provide access to a wide range of investment options and markets. They have expertise and resources to research and analyze stocks, allowing investors to make more informed decisions. Brokers also offer tools and platforms that facilitate buying and selling stocks, providing a seamless and efficient trading experience. Secondly, brokers can provide valuable guidance and advice based on their market knowledge and experience. They can assist investors in identifying investment opportunities, developing strategies, and managing risk.

Additionally, brokers often offer additional services such as portfolio management, retirement planning, and access to initial public offerings (IPOs). They can also facilitate trading in international markets, providing opportunities for diversification. Lastly, brokers ensure compliance with legal and regulatory requirements, protecting investors' interests and providing a layer of security. While it is possible to buy stocks without a broker, engaging the services of a reputable broker brings expertise, convenience, guidance, and a comprehensive range of services that can enhance the overall investment experience.

UK Stock Broker Fees: What you Need to Know

When it comes to fees, UK stock brokers are in the business of making money. As such, you will always need to pay a fee of some sort. The exact pricing model will vary from broker-to-broker, and the one you opt for should be depending on how often you plan to trade.

To give you an idea of what you are likely going to pay in 2022 - check out the comparison table below.

| Stock Brokers | Charge Per Trade | Deposit / WIthdrawal Fees | Inactivity Fee |

| eToro | Free | £5 per withdrawal | £10 per month after 12 months |

| Alvexo | Free | None | €10 per month after 3 months |

| Plus500 | Free | None | £10 per month after 3 months |

| XTB | Free | None | £10 per month after 12 months |

| Pepperstone | Free for US stocks | None | None |

| AvaTrade | Free | None | £50 per quarter after 3 months |

| Hargreaves Lansdown | £5.95 – £11.95 | None | None |

| Trading 212 | None | None | None |

| Fineco Bank | £2.95 per UK stock trade | None | None |

| Degiro | £1.75 + 0.014%, max £5 | None | None |

| Barclays | £3 for ETF trades or £6 for stock trades | None | None |

Currency Conversion Fee

Most UK stock brokers will charge a 'currency conversion' fee. In the vast majority of cases, this is charged when you attempt to access international shares. In other words, if you're from the UK and investing in pounds, but you want to purchase shares listed in the US, the respective stocks will be priced in dollars. As such, the broker will charge you a currency conversion fee, which is multiplied against the value of your order.

For example:

- You want to purchase £10,000 worth of Disney shares - which are listed on the New York Stock Exchange in US dollars

- Irrespective of Disney's share price, you will pay a 0.5% fee on the amount you invest

- On an investment of £10,000, the fee amounts to £50

There is often an exception to the above, insofar that brokers like eToro will charge you its 0.5% currency conversion fee when you make a deposit. So, if you deposit £1,000, you will pay a conversion fee of £5. The reason for this is that eToro gives you access to over 17 stock exchanges. As such, it denominates all account balances in US dollars, which then gets you unfettered access to both UK and international markets.

Share Dealing vs Stock CFD Trading

It is important that you are able to make the distinction between a traditional 'share dealing' platform with that of a 'stock trading' site - as the two asset classes are somewhat different

Share Dealing

When looking at the popular share dealing platforms, these are online brokers that allow you to invest in companies in the traditional sense. For example, if you purchase 10 shares in BP, you actually own the underlying stock. As and when BP distributes dividends, you as a stockholder will be entitled to your share. Owning a stock via a UK stock broker also gives you the right to annual general meetings and other important company events.

Stock CFD Trading

Stock trading in the form of CFDs (contracts-for-differences) enables you to speculate on the future value of your chosen company without taking ownership. This will suit those of you that are looking to make gains in the short term. For example, you will have the capacity to apply leverage on your trades by up to 5:1 on stocks.

Users can also short-sell companies - meaning that there is a potential to make gain if the value of the stock declines. Stock CFD trading is also conducive for trading with ultra-small pricing movements, as fees and commissions are typically wafer-thin. On the flip side, you will not be entitled to dividends when trading stock CFDs, as you don't own the asset.

UK Stocks and Shares ISAs

If your chosen UK stock broker gives you access to an ISA, this will be highly beneficial for you. This is because stocks and shares ISAs allow you to invest up to £20,000 per year - all of which will be exempt from capital gains tax.

If you don't utilize your ISA allowance, you will need to pay tax on any gains that you make when you sell a stock. If you already have an ISA elsewhere, some UK stock brokers allow you to transfer your stocks over without paying a fee.

Is My Money Safe at a UK Stock Broker?

For example, UK stock brokers must keep client funds in segregated bank accounts, meaning that they can't use the money for their working capital. As your money is ringfenced, it should be safe even if the broker collapsed. An even more stringent safeguard is that of the Financial Services Compensation Scheme (FSCS).

Most UK brokers are covered by the scheme, meaning that the first £85,000 is protected in the event the broker ceased to exist. With that being said, the FSCS protection won't cover unsuccessful trades. Instead, it is there to protect client money from a broker collapse.

Recent News To Consider Before Choosing A Stock Broker

Last updated: 17/05/2023- The stock market can be very volatile as it is influenced by factors from around the globe. The best way to stay on top of current happenings and to make educated trading decisions is to keep up with the latest relevant news. Here are some things to consider before choosing a stock broker for your trading:

- UK Finance Fraud Report 2023 revealed that brits lost £1.2 billion last year. With cost of living on the rise, Brits are more likely to fall for financial scams as they seek to stretch their salary. Finance professionals have urged Brits to conduct careful research before putting money into any investment scheme and to only use schemes that are backed by regulated brokers.

- Over 10 million Brits are reportedly struggling with debt. This comes as the cost of living crisis continues to grow and more people are relying on credit to pay living expenses.

- Japanese shares jumped on Wednesday after a positive GDP report. The Nikkei 225 gained 0.8% to a value of 30,093.59. On other hand, Australia's S&P/AXS 200 dropped by 0.5% despite a positive wage increase report. South Korea also saw gains with Kopsi rising by 0.6% however, Hong Kong’s Hang Seng lost 1.2%. This resembles a mixed market for Asian stocks.

- The US stock market remains bearish with the Dow, Nasdaq and S&P500 dropping this week. The Dow Jones Industrial Average fell by 1.01% while the Nasdaq saw a loss of 0.18% and the S&P500 dropped by 0.64%. The US stock market has been bearish recently as a result of economic uncertainty.

Conclusion

This guide has provided a comprehensive breakdown on some of the most popular stock brokers available to use in the UK. Should you choose to begin trading with a broker in the UK, users should conduct their own research to review and analyse their preferred brokers in the UK.